The energy utility sector has provided its fair share of headlines this year. From crippling blackouts in SA, stand-offs between AGL and the Australian government over the Liddell coal power station to soaring energy prices, it has certainly been a talked about issue.

One company that can form part of the solution is Locality Planning Energy (ASX: LPE). LPE is an electricity retailer (largely in QLD) that specialises in serving strata communities. In a strata community, each lot pays its separate network and metering charges. Locality Planning Energy comes in and installs a parent meter and thus consolidates the network and metering charge for the strata. After this procedure is completed, the strata then becomes an embedded network with LPE as the electricity retailer.

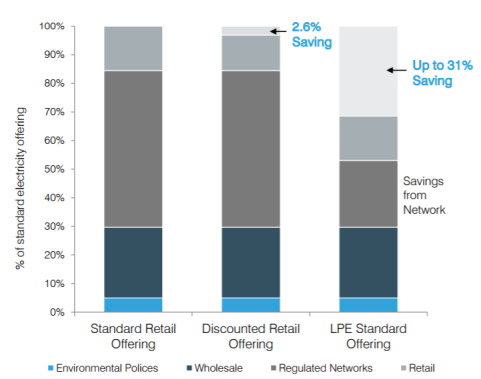

Structural savings allows for win-win situations

The result is a “structural” saving which can be passed on to the customers (usually >20%) and maintain LPE’s margin. In the past, Locality Planning Energy has had a gross margin (from purchasing wholesale spot price to selling retail electricity) of 17-19%. While Locality Planning Energy has only been listed for 2 years (it backdoor-listed in early 2016 and was granted its electricity retailer authorisation in Nov 2014), management has guided that it is a maintainable margin.

Additionally, the revenue of converted strata is contracted for 5-10 years to ensure the return of LPE’s parent meter investment. As of October 2017 the average contract length is 7.2 years. This long-term contracted revenue ensures that customer churn will not be a problem until after 2022 and beyond. This means that revenue will be retained as they sign more customers.

- How LPE makes their margin

A situation with long growth runway

Naturally, this value-for-money appeals to a lot of people. Locality Planning Energy’s high growth since its inception shows this.

Accumulated monthly billing

It has an original target of 450 GW to be under management by March 2020. While this represents an ambitious ~10% of the South-East Queensland strata communities (where they are currently based), LPE has stated that they are also targeting the rest of Queensland and also NSW.

To further add value for strata community, Locality Planning Energy has also began offering embedded network management through Locality Embedded Networks (LEN). Recent regulatory changes has made it compulsory to have an embedded network manager. While this is not expected to provide significant revenue, this is smart move as by offering LEN to embedded networks, it provides a footing for LPE to maintain relationships with future customers.

Promising management team with skin in the game

One of the most important thing in assessing whether Locality Planning Energy can achieve its full potential is to assess the management team. In such an early stage company (as of end of FY17, they have 26 FTE), the management team can mean the difference between a great promise and getting to the promised land.

The two co-founders, Damien Glanville (CEO) and Ben Chester (COO) are two entrepreneurs who met whilst working on Sunshine Coast Solar Farm project. Damien successfully commercialised and sold the rights to the solar farm as the first private project not reliant on government subsidies. Ben has had seven years’ experience in the energy development and deployment area.

So far, the pair has proven that they can deliver. They have met their 100GW milestone 5 months ahead of schedule.

Additionally, they both have significant skin in the game, each owning ~18% of LPE. The alignment of incentives with outside shareholders ensures that management will seek to create long-term value.

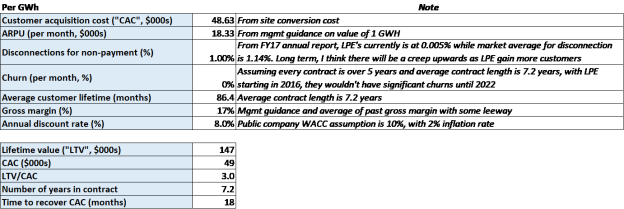

Locality Planning Energy’s unit economics shows that there is potential in the model

Valuation at such an early stage company with a highly changing background is difficult. The valuation is certain to end up wrong- but I think that doing the analysis still provides rough guidance to the attractiveness of the investment. Additionally, forecasting in this case needs to be as simple as possible.

In this blog post, I will not do a DCF analysis (you can do your own analysis yourself); rather I will do an analysis of the unit economics per GW managed (1 GW is roughly the per annum requirement of 2 strata communities of 30 lots each. Their current average community size is 63 lots, based on mgmt’s guidance).

In this case, I think unit economics analysis can provide a constructive start to assess LPE due to the subscription-like nature of LPE’s contract. Unit economics valuation is also helpful since it is likely to be an analysis that an acquiring company would do to assess the valuation of LPE’s contract book. (Please note that the analysis relies on past data and their future unit economics will almost certainly change)

In such analysis, the situation where the error proves to be damaging is where the unit economics deteriorates severely.

So, based on this unit economics valuation, LPE’s 2Q18 projected GW under management (150.4 GW) has a value of $22m, while their targeted 450GW by FY20 will be worth ~$66m.

The fully diluted market cap when I bought into the company was $50m.

So, why was I still comfortable buying into it even though the market already partly assumed that LPE will get to 450 GW in 2.5 years’ time? It’s because of a combination of things:

- I have assumed that the average customer lifetime is 7.2 years. I think it will actually be higher than that, however I think it is conservative since the churn rate is not yet known

- It doesn’t take into account an acceleration in the rollout of GW under management. There will be some efficiencies in their rollout process.

- Once management gets to 450 GW, there is no reason for them to stop there

- There is likely to be a premium on this stock since the market is vast- markets can give these sorts of businesses large premiums due to the size of the market

- Management as large shareholders, are highly incentivised to keep growing the company profitably

Nevertheless, significant questions are still present

There is high risk associated in this company. It is an early stage, rapidly growing company in a fast changing environment. In such a large and important market, there are bound to be highly motivated players. In short, there are lots of things that can break the investment case.

With my unit economics analysis, the biggest question marks are the churn rate once the initial contract is finished AND how much customer acquisition costs will increase in the future. I think customer acquisition costs will inevitably increase as more competition joins the market (in fact, there are more competitions coming in the space with similar offerings, incl from ex-related parties to LPE, incl Jason Hague- Apex Energy and Perry Stahmer- StarCorp Energy).

Related to this, one the worst scenario that can happen is large competitors with lots of money starting to compete with LPE. They can sign a lot of customers very quickly. Additionally, in that case margins of future customers will come under pressure and the business becomes less attractive. The competitors can realistically prevent LPE from ever achieving sufficient scale.

There are also additional financing risk to the company- they are currently looking at debt financing for working capital which hasn’t eventuated for a while.

The future is still difficult to predict

As with any fast growing company, most of the value will come in the future, and the future is difficult to predict. Ironically, for management the best way to ensure attractive CAC and LTV is not to obsess over CAC and LTV. As David Skok said, management needs to “focus your energies on solving the problems of improving product/market fit, and making your customer acquisition repeatable, scalable and profitable. ”

Disclosure: I own LPE shares. Nothing here is advice

Great note Mark. Market will pay a premium for the predictable cash-flow, but also doesn’t allow the stock to be traded on heady multiples, because of this predictability. Huge market that will require operations to be scaled, but good to see management working hard to fine tune operations in SE QLD.

LikeLike

Thanks Alex. That’s true- and LPE isn’t a software business that can grow virally over the internet as well…their distribution and business model is a lot more traditional than other stocks that can grow explosively

LikeLike

SMSF’s will pay a premium and most likely keep it at a premium if they pay out a good fully franked yield which given their cash flow they should. The yield trade will be alive and well in Australia for while yet. Agreed it cant scale like a software business but should trade on a multiple something similar to AGL with a discount for its size. It looks reasonable value at these levels $0.19 on 3/5 year view

LikeLike

Thanks Mark! I think we’d all be very happy if it hits $0.19 within 3/5 years haha. On the dividend front, I’m not sure whether mgmt will be best served in paying one asap or waiting later until they generate higher income (and paying larger div). The focus for now should be on growing their under mgmt GW and they should use debt to accelerate it- especially given their predictable cash flows

LikeLike