A good roll-up can be long and enjoyable. No no, I’m not talking about the lolly. The type of roll-up I’m going to be talking about can be much sweeter or sourer depending on your timing and how it was put together.

If you had your ears open, you would have been privy to the worst kind of roll-ups. The type that blew up. ABC learning’s collapse of child-care roll-up, from what was then the world’s largest operator of child care operator. In more recent times, there were Slater and Gordon (law firms roll-up) and Retail Food Group (restaurant franchises roll-up).

The road is indeed littered with disasters.

The difficulty in sustaining a successful roll-ups is structural. As the holding company becomes larger, it requires even larger acquisitions to keep boosting its revenue and profits. The integration then becomes harder and more error-prone. Add debt into the equation and the mix can be even more explosive.

However, as Mark Tobin’s wrote:

“As a previous mentor of mine once said to me, “the best time to own a business involved in a rollup strategy is the early days”. Rollups can be very successful and very profitable to investors in the early days. Just pull up some charts of G8 Education Ltd (GEM:AX) or Greencross Ltd (GXL:AX) in the first few years of their rollup strategy to see why being in at the start can be very rewarding for shareholders.”

The theory behind a successful roll-up strategy is the public market premium over private market valuations and how the holding company can arbitrage their shares to purchase additional growth. Find the Moat has a great and concise article about how the premium can be used.

Now, after that brief introduction of the roll-up concept, I will now tell you about a roll-up that I have taken a position and remain invested in.

This is a piece that was way overdue and one I hesitated writing about because much of my current return was lucky. Plain old luck. I will expand on this serendipity at the end of the article.

HRL Holdings Limited

HRL Holdings Limited (ASX: HRL), formerly known as Hot Rock Limited is a holding company for a roll-up of specialised environmental services. It is involved in laboratory services for hazardous materials, environmental and food as well as geotech engineering services. Prior to 2014, it was a geothermal energy company. It then became a shell for Kevin Maloney and Darrren Anderson to create what is now HRL.

Kevin Maloney (Non-exec Chairman), Darren Anderson (Exec Director) and Steven Dabelstein (CEO) had experience scaling up a company previously. Kevin was the founder and Exec Chairman of The MAC Services Group, an ASX listed mining accommodation provider that was acquired in 2010 for $650m. Luck probably played a part in that sale, selling out of the business at the middle of the mining boom peak. Darren was the Executive Director and COO of Diversified Mining Services when at its peak had revenue of ~$200m and 850 FTE. Steven was the GM Commercial for Diversified Mining Services, where he worked for Darren. Diversified Mining Services wasn’t as lucky as MAC Services as it felt the full impact of the mining downturn, sold in 2014 for $20m.

They remain a substantial owner of HRL, with Kevin Maloney owning 61.3m shares (~12% of HRL) and Darren Anderson owning 21.3m shares (~4% of HRL).

Environmental service providers is a scale game

Environmental services industry is a ~$5 billion industry with low market concentration. The top 4 players (ALS, BOM, SGS Australia, Buerau Veritas) were estimated by IBISWorld to have ~25% of the industry. IBISWorld classified the industry broadly to include geotechnical modelling for stress analysis, to metrological services and weather station, to material testing for manufacturing industry. Recently, the industry’s growth has been limited from the mining slowdown. However, there are pockets in the industry that showed strong demand, including water supply, sewerage and agriculture sector.

Within this industry, it pays to be scale operators. Environmental services providers have high initial capital requirements for equipment and systems. Each test generally provides small revenue. Access to large number of work is then critical to be profitable. Customers tend to be sticky. It’s caused by a number of reasons. Firstly, customers are usually looking for “compliance” when choosing a lab provider. Secondly, environmental test costs tend to be minor in the overall costs yet is extremely important. Think of accounting firms and how they have sticky customers.

Kevin and Darren understood this dynamic. Additionally, there is a considerable lead-time to be accredited by NATA and IANZ. Acquisitions of companies with existing clients and growing from there thus becomes more advantageous than starting from scratch.

The original piece of the roll-up was OCTIEF, an asbestos and hazardous materials testing company which was bought out of administration by the pair.

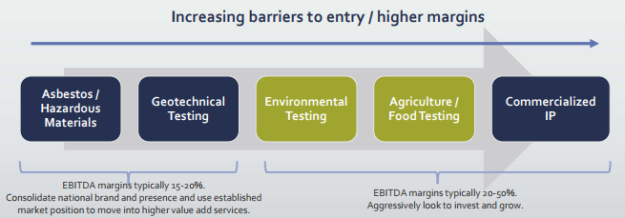

HRL’s segment acquisition strategy

The larger companies, such as ALS and SGS, mostly have exposure to the mining and oil and gas sectors through resources lab services. HRL have so far avoided such exposure and focused elsewhere.

HRL has begun the roll-up since 2014 in an attempt to reach scale

Acquisition history:

- OCTIEF (2014): Operates in environmental consulting and hazardous materials testing and lab market. Does analysis, audits, sampling of asbestos. The acquisition that started it all

- Precise Consulting (2015): Similar business as OCTIEF, but operates in New Zealand. Services include contaminated land analysis, soil sampling, dust monitoring, air quality monitoring, asbestos auditing. Acquired at ~3x EV/EBIT for ~NZD 5.7m

- AACEnvironmental (2015): Primarily involved in asbestos auditing in ACT. This wasn’t HRL’s best acquisition, with Arthur Watson, ex-CEO of AACEnvironmental resigned pre-agreed period. Eventually AACEnvironmental was folded into OCTIEF. Acquired for ~AUD 1.5m cash

- RJL & Associates (2016): Involved in property contamination testing (meth contamination) and work place drug testing in North Island of NZ. A bolt-on acquisition which was immediately folded to Precise Consulting. Acquired at ~2.8x EV/EBIT for ~NZD 0.5m

- Morrison Geotechnic (2017): QLD geotechnical engineering and environmental service. Provides exposure into the infrastructure sectors. Acquisition to further enhance HRL’s capability into the geotechnic market. Acquired at ~5x P/E for ~AUD 3.8m

- OCTFOLIO (2017): Specialised software vendor for information management software solutions for asbestos and hazardous materials. Supports other HRL core businesses. Acquisition to further enhance HRL’s capability and presented cross-selling opportunity. Acquired for ~AUD 2.8m

- Analytica Lab (2017): NZ analytical chemistry lab with presence in environmental and food/agriculture testing market. The acquisition provides the next growth hub to move into the higher margin agricultural and food testing. Analytica is also a market leader in honey testing in NZ and strong position in liquid milk analysis and food origin testing via strategic alliance with partners including MilkTestNZ. It also has 26% interest in CAIQtest, which is a NZ based lab that provides testing services for clients exporting from Australasia to China, including a focus in infant milk formula. Analytica’s lab process and know-how is considered to be first tier in NZ with fast turnaround times. It was acquired at ~6x EV/FY18f EBITDA. HRL issued scrip with Analytica’s acquisition and provided a board seat to Analytica’s management

Based on the number of acquisitions, you would have thought that perhaps they have grown enough. That is not the case. HRL management was attempting to reach greater scale with each acquisition.

Prior to Analytica, HRL was a sub-scale company in an industry where scale matters. I have previously written about how being sub-scale prevents a company to be sustainably profitable.

In FY17, HRL had ~$1.5m of overhead costs with an estimated full year contribution of operating businesses (incl Morrison Geotech and OCTFOLIO) EBIT of ~$2.6m. In another words, overhead represented ~60% of operating businesses’ EBIT. That’s not sustainable.

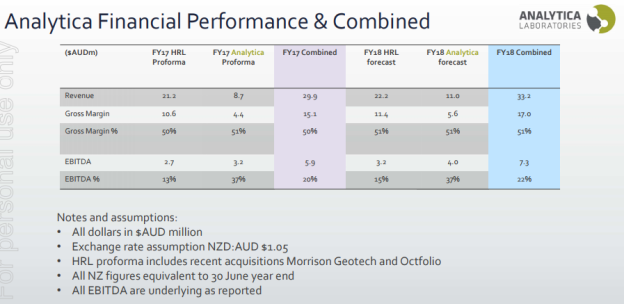

The gloomy backdrop is why Analytica’s acquisition was major news. Firstly, Analytica more or less doubled HRL’s profitability. Secondly, it gave HRL a way into the food and environmental testing, a segment with higher margin. Thirdly, Analytica has a reputation as a first tier lab, with first class processes. HRL can spread that knowledge to the rest of the group. However, even with the Analytica acquisition, I am still unsure whether HRL has enough scale.

Analytica’s acquisition gave HRL a signfincant boost

Furthermore, if I had a look at Kevin and Darren’s background, I would guess that they will not stop until HRL has revenue of $100m. That means the roll-up is likely to still be in the early stage.

What is apparent from HRL’s acquisition history is that they are largely sensible when paying for businesses. That is important. They have acquired a mix of growth hubs (OCTIEF, Precise Consulting, Morrison Geotechnic and Analytica) and bolt-on acquisitions (AACEnvironmental, RJL, OCTFOLIO) at reasonable prices.

HRL has shown some ability to grow organically

HRL has slowly grown its acquired businesses. Unfortunately, the growth hasn’t produced much free cash flow as it struggled to reach scale.

OCTIEF since 2014 has expanded to Darwin, Perth and opened/expanded its lab networks. Similarly, Precise Consulting has expanded to Wellington, Dunedin and Auckland. HRL has also won contracts from blue-chip customers. Examples include:

- Chorus NZ: national HAZMAT audit of 840+ assets and other inspection types for Precise Consulting (2015)

- QLD Department of Transport and Main Roads: service agreement for Morrison Geotechnic to be able to provide field geotechnic engineering and lab services (2017)

- MilkTestNZ: expansion of milk products and residue testing for Analytica and HRL businesses (2017)

Along with geographical growth, they have expanded their capability. All OCTIEF and Precise labs now offers meth investigation services. OCTIEF has also in FY17 achieved a NATA accreditation for gravimetric dust sampling and added further chemistry for soil analysis.

Management will need to do a better job of growing profitably from its existing businesses for HRL to reach its full potential.

Significant risks are still present

As I mentioned in the beginning of the article, the roll-up strategy has risks.

Firstly, integration risks are present. I personally think that integration of growth hubs (OCTIEF, Precise Consulting, Morrison Geotechnic and Analytica) have less integration risk than the bolt-on acquisitions. Management has said that they have a light-touch integration when they acquire the growth hubs into new segment. I can believe that. The higher risks are in the bolt-on acquisitions which will be more thoroughly integrated into existing operations. Cost synergies will be a larger business case for the bolt-on acquisitions.

Secondly, HRL needs to show that they can operate and grow profitably. This will help HRL to ensure that their scrip remain at the high multiple needed to arbitrage their public market premium effectively. HRL will need to start generating free cash flow and increase return on invested capital. Management has stated that current overhead is enough for now and will not grow substantially overtime. That might be right, but in most businesses overheads somehow still find a way to grow.

Thirdly, there is the risk of management making bad acquisitions. The insider ownership and experience of management should mitigate some of this risk. To date, they have been sensible in their acquisition strategy and how much they pay for acquisitions.

Largely a lucky break

This is where I will say that my position and average buying price in HRL was lucky. I first noticed the company when Mark Tobin wrote about it in October. Mark Tobin is an ex-Wilson Asset Mgmt analyst who likes growth at reasonable price stocks. He looks at micro and nano caps and does a great job highlighting interesting stocks. (thanks Mark!)

The stock was near its 52 week lows at market cap of $20m. After analysing HRL, I took a small stake for a couple of reasons:

- Experienced individuals behind it with skin in the game (pre-Analytica dilution, Kevin and Darren had ~40% of HRL)

- Management track record of paying conservatively during acquisitions

- With the then Morrison and OCTFOLIO acquisition, they were bulking up to somewhat reach marginal profitability

It looked interesting, and the roll-up model can be quite powerful in the beginning.

Little did I know that a couple of days later HRL went into a trading halt with the Analytica acquisition and a capital raising at 8.5c. I applied for the full amount and was scaled back, but that meant that I was able to purchase HRL at lower than market price (post-Analytica announcement, HRL traded mostly between 10-12c).

It was a lucky break, but hey, I will take what I can get.

Disclosure: I own HRL shares. Nothing here is advice

Hi Mark it’s Jackson. Nice article and good stuff! I have a few general Q’s… actually I might email them to you instead.

LikeLike

Thanks for the Qs Jackson- see your email!

LikeLike